information

Key Features of Strategy

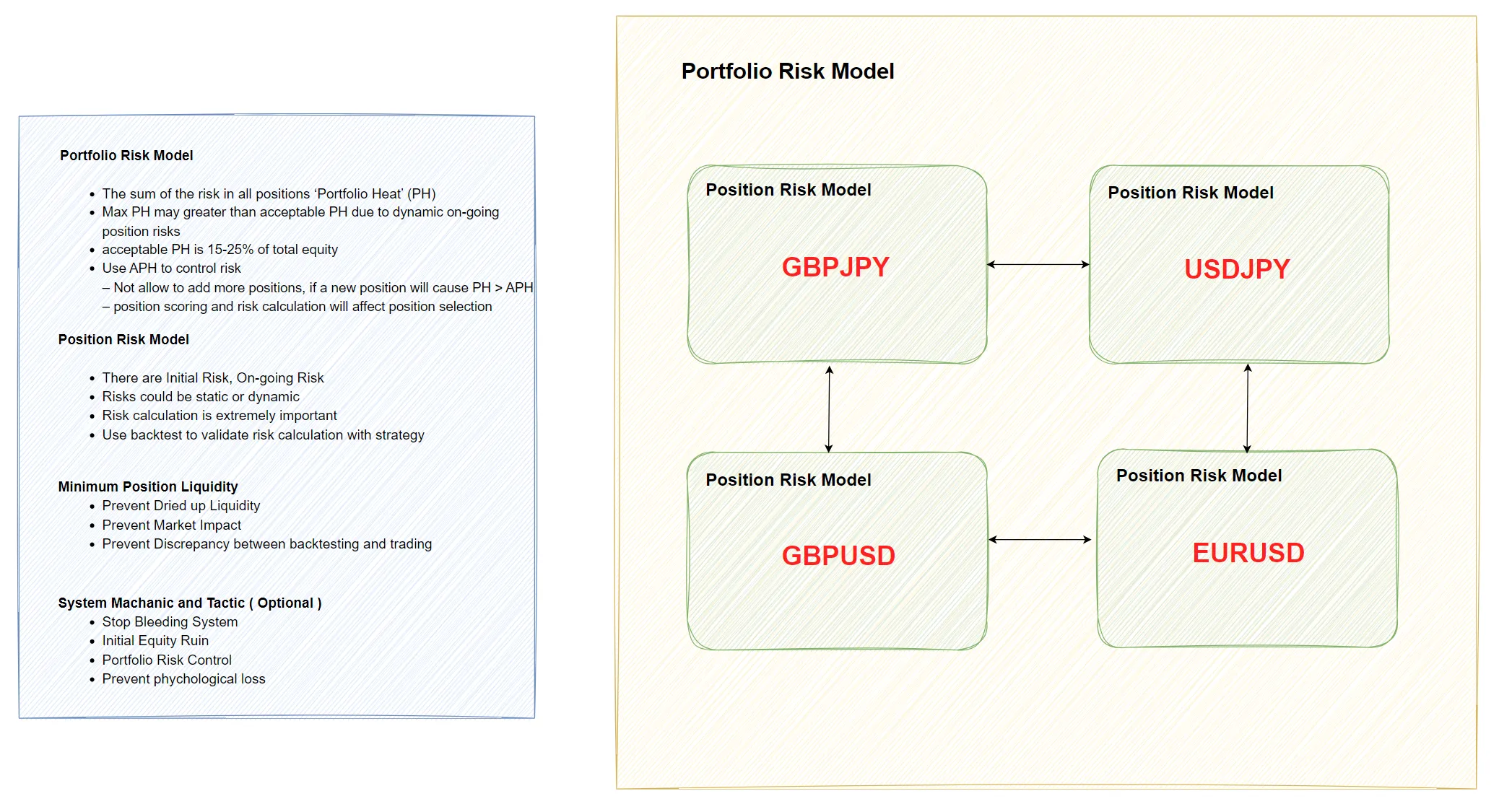

The EA trades in the Forex CFD market, trading in 3 currency pairs: GBPJPY, USDJPY, GBPUSD and EURUSD with the following key conditions:

-

These currency pairs have volatility according to the opening/closing times of the US or EU trading sessions.

-

These currency pairs have an overarching price trend.

-

These currency pairs have clear catalysts driving movements.

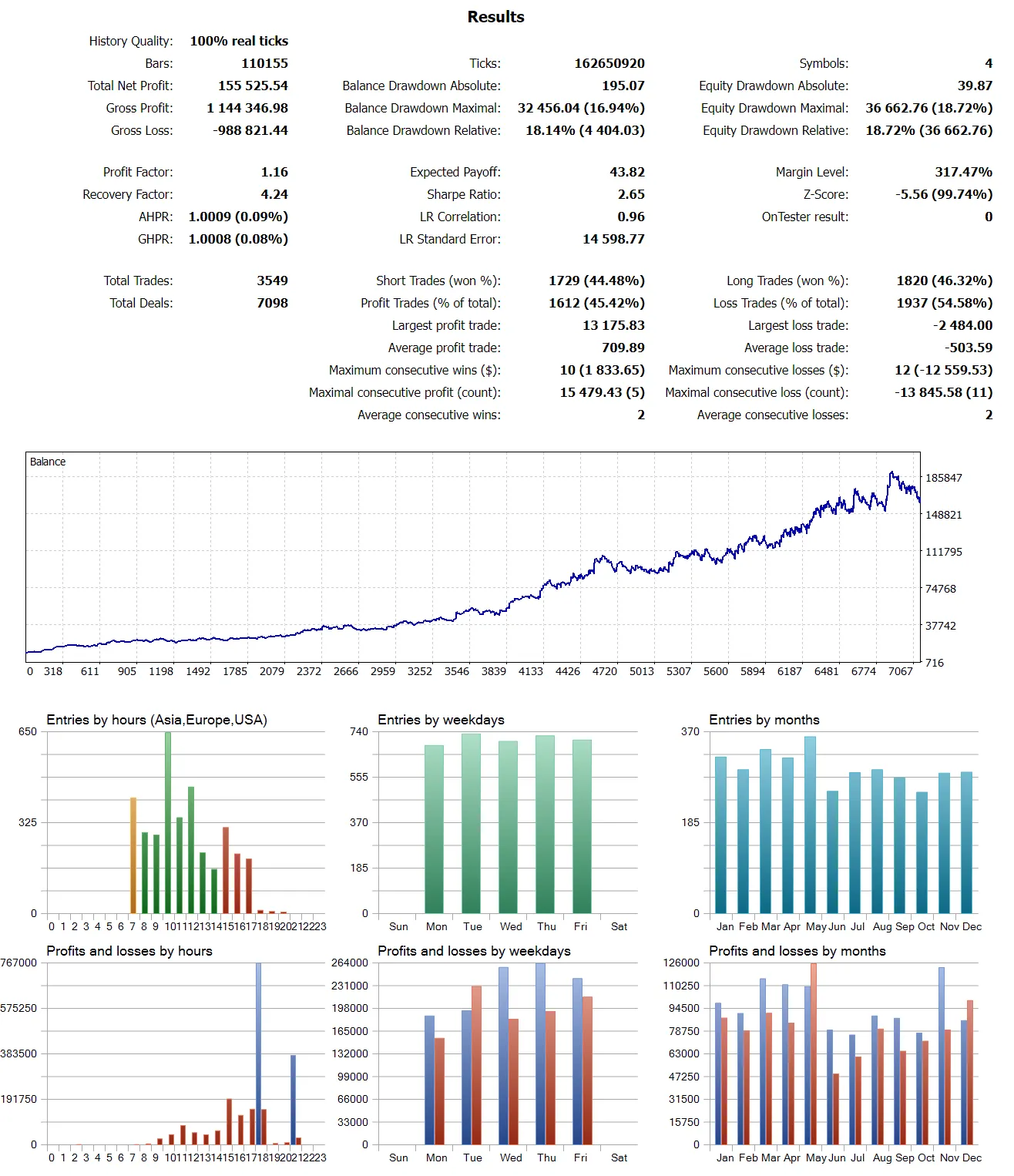

The mechanisms and conditions of this strategy were derived from backtesting historical data from a high-quality data provider (Tick Data Suite: Data Quality 100%) from 2012-2024, over a 12-year period. This data was rigorously researched and back tested according to statistical principles, eventually becoming the EA Triangle Alchemist. The objective is to generate stable, sustainable long-term returns with low risk across all economic conditions.

The key points

-

Places great emphasis on Risk Management and the long-term Robustness of the system as the main priority.

-

Low risk level, even for long-term investments or during periods of high market volatility.

-

Easy to use with a clear systematic investment process that does not rely on the discretion of the investor, which is one of the strengths of the Quantitative & Systematic investment strategy.

Summary of Trading Rules

-

Trading Approach (Principle): A breakout time-based trading strategy that focuses primarily on order management tactics and money management. Suitable for medium to long-term investors (expected timeframe of 3 to 6 months or more).

-

Risk Management: Trading the 4 currency pairs to diversify the overall portfolio (Diversified Trade Management).

Who is EA not suitable for?

The EA is not suitable for investors who want guaranteed returns in a short period of time, or want to preserve their principal with absolutely no risk. It is also not suitable for investors who lack an understanding of systematic, rules-based investing philosophies.

Key Risk To Be Aware of ?

There are 3 main risks:

-

Risk from structural changes in the economic system and long-term investor behavior, which could impact the statistical edge of the investment strategy.

-

Trade execution risk, arising from the trading process being unable to execute orders as specified, e.g. issues with the VPS running the EA or the broker’s server.

-

Short-term return volatility risk, from not giving the strategy enough time to work and generate expected returns from its statistical edge. The recommended investment timeframe is 3-6 months or longer (Reference from bootstrapping simulations).

Backtesting Principal

-

The strategy was backtested from 2012 to 2024, a period of over 12 years, to test the stability of the system across all economic cycles. The starting investment was $10,000.

-

The data used for testing was split into a 7-year in-sample period and a 5-year out-of-sample period.

Strategy Specifications

-

The system will close all orders before the end of the day to facilitate risk management and account funding/withdrawals for the account holder.

-

The system will hold no more than 7 orders per day

-

Commission is set at $3 per lot (prop firm standard).

-

Order execution delay or latency is set at 275ms (standard broker latency).

-

Spreads are set based on actual Tick Data Suit (Dukascopy Bank)

-

Stop loss is applied to every position (max risk per trade can be set).

-

Not sensitive to slippage and commission costs.

-

Does not use martingale or grid systems.

** ผลการทดสอบย้อนหลังไม่ได้เป็นสิ่งยืนยันถึงผลการดำเนินงานในอนาคต เราจึงได้ทำการวิจัยอย่างละเอียดเพื่อเพิ่มโอกาสถึงผลตอบเเทนในอนาคต

Backtesting Result (Include out-of-sample)

-

Max Risk per trade ( % of balance ) = Fix Loss max 1 % of Balance

-

Initial Balance = 10,000 $

-

Leverage = 1:30